When you click on links to various merchants on this site and make a purchase, this can result in this site earning a commission. Affiliate programs and affiliations include, but are not limited to, the eBay Partner Network.

Round Numbers AI Experimental Algorithm Trading Indicator for TradingView:

$100.00

Round Numbers with Signal Clean Up Analysis - Backtestingfeature enables quick short-term evaluation of a strategy within seconds

- Deep Backtestingfeature allows to see if there is a long-term potential in a strategy

- Full-cycle trading system for different trading styles (intraday, swing, trend) with signal cleanup and analysis

- Provides TP (Take Profit) and SL (Stop Loss) levels with alerts for every step of the trade

- Every calculation is done on a confirmed closed candle bar state, so the indicator will never repaint

- Works with all popular timeframes for any trade style: 1M, 3M, 5M, 15M, 30M, 1H, 4H, D.

NOTE: At position open - there will be calculated Take-Profit and Stop-Loss targets, however each target is considered hit, when candle bar closes breaking that target, so Take-Profit and Stop-Loss when hit will slightly differ then levels at position open!What sets our product apart from many others is our provision of Backtesting results for every Trading Strategy. These results substantiate the potential of our algorithms. Certainly, as with any form of "investment," there is an inherent risk. It's important to note that our approach is inherently riskier than strategies like buy-and-hold or investing in low-risk options such as a fixed 1.5-5% Certificate of Deposit (CD) in a bank. However, our algorithms exhibit significantly more promising potential outcomes. (It's worth noting that while past performance doesn't guarantee future results, our algorithms are based on patterns that tend to repeat themselves!) This potential is particularly evident in FOREX pairs, indexes, stocks, and cryptocurrency coins. - - Unique mathematical algorithm based exclusively on round numbers!

- - Customizable Backtesting for a specific date range, results via TradingView strategy, which includes “Deep Backtesting” for largest amounts of data on trading results.

- - Trading Schedule with customizable trading daily time range, automatic closing/alert trades before Power Hour or right before market closes or leave it open until next day.

- - 3 Trading Systems.

- - Static/Dynamic/Trailing Stop-Loss setups (Stop-Loss will be moved to Entry after TP1 is taken, which minimizes risk).

- - Single or Multiple profit targets (up to 5).

- - Take-Profit customizable offset feature (set your Take-Profit targets slightly before everyone is expecting it!).

- - Candle bar signal analysis (matching candle color, skip opposite structured and/or doji candle uncertain signals).

- - Additional analysis of VWAP/EMA/ATR/EWO (Elliot Wave Oscillator)/Divergence MACD+RSI/Volume signal confirmation (clean up your chart with indicator showing only the best potential signals!).

- - Advanced Alerts setup, which can be potentially setup with a trading bot over TradingView Webhook (NOTE: This will require advanced programming knowledge).

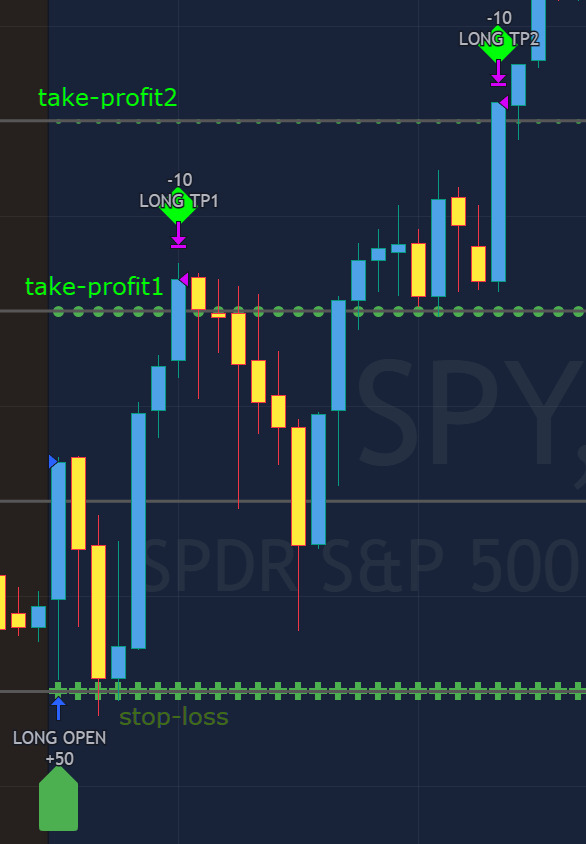

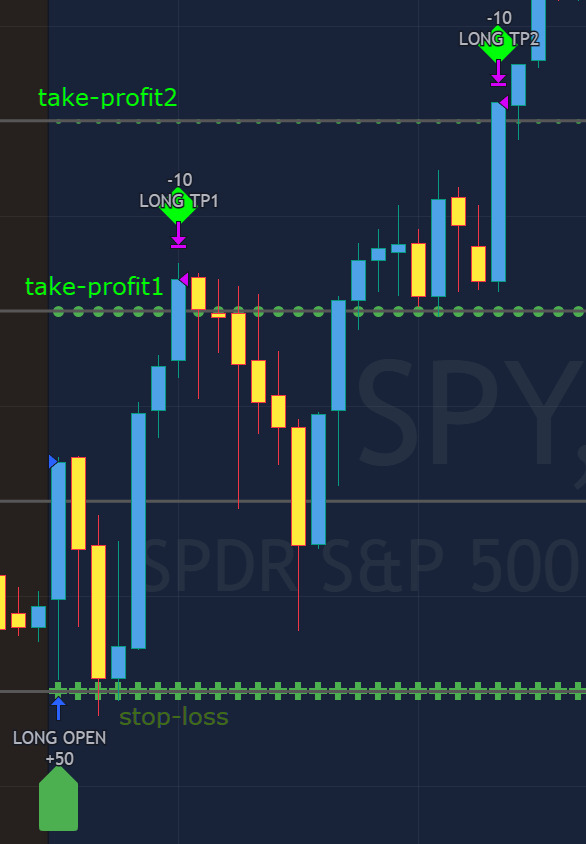

Signal labels, plots, colors - Gray lines indicate the Round Numbers.

- LONG(↑)open:green"house" looking arrow below candle bar.

- SHORT(↓)open:red"house" looking arrow above candle bar.

- LONG/SHORT take-profit target: green/red circles (multi-profit > TP2/3/4/5 smaller circles).

- LONG/SHORT stop-loss target: green/red + crosses.

- LONG/SHORT take-profit hits: green/red diamonds.

- LONG/SHORT stop-loss hits: green/red X-crosses.

- LONG/SHORT EOD (End of Day | Intraday style) close (profitable trade): green/red squares.

- LONG/SHORT EOD (End of Day | Intraday style) close (loss trade): green/red PLUS(+)-crosses.

Main Configuration and Trading Schedule Settings - Round Number up|down unit / distance between the 2 round numbers. May need to experiment with this for best setting. Here are good working examples for popular instruments for default 1 round number unit: BTCUSD > $1 (set it to at least $100) | SPY: > $1 (best setting) | FOREX (all major pairs): > 10PIPs.

- Select your start and/or end dates (uncheck “End” for indicator to show results up to the very moment and to use for LIVE trading) for Backtesting results, if not using Backtesting – uncheck “Start”/“End” to turn it off.

- Use TradingView “Strategy Tester” to see Backtesting results

NOTE: If Strategy Tester does not show any results with Date Ranged fully unchecked, there may be an issue where a script opens a trade, but there is not enough TradingView power to set the Take-Profit and Stop-Loss and somehow an open trade gets stuck and never closes, so there are “no trades present”. In such case - manually check “Start”/“End” dates or use “Depp Backtesting” feature! - Trading Schedule: This is where an Intraday Session or any custom session can be scheduled. Turn it ON. Select trading hours. Select EOD (End of Day) setting (NOTE: If it will be OFF, the indicator will assume a position is held open until next day!). Please note the EOD trade closure times with the 2 different Intraday close settings when turned on:

At Market CloseTimeFrameTrade/Position Close Time1/3/5minwill close at 15:55pm ET15minwill close at 15:45pm ET30minwill close at 15:30pm ET45minwill close at 15:45pm ET60minwill close at 15:00pm ETBefore Power HourTimeFrameTrade/Position Close Time1/3/5minwill close at 15:00pm ET15minwill close at 15:00pm ET30minwill close at 15:00pm ET45minwill close at 15:00pm ET60minwill close at 15:00pm ET - Trading Systems: 1) "Open Until Closed by TP or SL": the signal will only open a trade if no trades are currently open/running, a trade can only be closed by Take Profit, Stop Loss or End of Day close (if turned on) | 2) "Open Until Closed by TP or SL + OCA": Same as 1), but if there is an opposite signal to the trade which is currently open > it will immediately be closed with new trade open or End of Day close (if turned on) | 3) "OCA (no TP or SL)": There are is Take Profit or Stop Loss, only an opposite signal will close current trade and open an opposite one or End of Day close (if turned on).

- Turn On/Off: Current Position SL + Opposite Position Open Signal on the same closing candle bar (If current trade hits Stop-Loss and at that same closing candle bar there is a signal for an opposite direction trade > indicator will close current position as Stop-Loss and immediately open an opposite position). NOTE: With this option turned on, there will be more trades, but not necessarily better results, since after Stop-Loss is hit, it may make sense to wait a little before opening an opposite trade, even if it matches the condition at the same time when Stop-Loss is hit, but sometimes it shows great results, so this setting/feature is included. NOTE2: This setting only will work/make sense with TP and SL style/behavior both be set to "Fully Closed Candle"!

- Turn On/Off: Turn On/Off: Current Position REGULAR SL | Only the SL + Opposite Position Open will trigger if turned on, IF NOT - THERE WILL BE NO STOP-LOSS AT ALL!!! NOTE: It is very dangerous to trade without Stop-Loss!

- Signal Candle Bar consuming Take-Profits - position/trade signal candle bar is so big that it consumes the first TP setting (If signal open candle bar is big enough it cover the first Take-Profit area > the signal can either be skipped, or all Take-Profit areas pushed ahead from signal candle bar close using smart formula)

- MULTIPROFIT | TP (Take-Profit) System: Once the trade is open, all Take-Profit target(s) are immediately calculated and set for the trade > once the target(s) is hit > trade will be partially closed (if candle bar closes beyond several Take-Profit targets > trade will be reduced accordingly to the amount of how many Take-Profit targets were hit)

- MULTIPROFIT: SL (stop loss) System | Static: SL is set at position open and remains such; Dynamic: Once ANY TP is taken > SL will be moved to Entry; Trailing: SL will be moved along the position (smart trailing stop-loss), at TP1 taken > SL moves to Entry, at TP2 taken > SL moves to TP1, at TP3 taken > SL moves to TP2 and so on.

- # of TPs (number of take profit targets): Just like it is named, this is where the number of Take-Profit targets is selected (NOTE: If "OCA (no TP or SL)" Trading System is selected, this setting won’t do anything, since there are no TP or SLs for that system).

- TP(s) offset: This is a special feature for all Take-Profit targets, where a customizable offset can be turned on, so that if the price is almost hitting the Take-Profit target, but never actually touches it > it can be captured. This is good to use with HHLL (Highest High Lowest Low), which is pretty much a Support/Resistance as often the price will nearly touch these strong areas and turn around…

Signal Analysis and Cleanup Settings - Candle Analysis | Candle Color signal confirmation: If closed candle bar color does not match the signal direction > no trade will be open.

- Candle Analysis | Skip opposite candle signals: If closed candle bar color will match the signal direction, but candle structure will be opposite (for example: bearish green hammer, long high stick on top of a small green square) > no trade will be open.

- Candle Analysis | Skip doji candle signals: If closed candle bar will be the uncertain doji > no trade will be open.

- Divergence/Oscillator Analysis | EWO (Elliot Wave Oscillator) signal confirmation: LONG will only be open if at signal, EWO is green or will be at bullish slope (select setting as desired), SHORT if EWO is red or will be at bearish slope.

- Divergence/Oscillator Analysis | VWAP signal confirmation: LONG will only be open if at signal, the price will be above VWAP, SHORT if below.

- Divergence/Oscillator Analysis | Moving Average signal confirmation: LONG will only be open if at signal, the price will be above selected Moving Average, SHORT if below.

- Divergence/Oscillator Analysis | ATR signal confirmation: LONG will only be open if at signal, the price will be above ATR, SHORT if below.

- Divergence/Oscillator Analysis | RSI + MACD signal confirmation: LONG will only be open if at signal, RSI + MACD will be bullish, SHORT if RSI + MACD will be bearish.

- Volume signal confirmation: LONG/SHORT will only be opened with strong Volume matching the signal direction, by default, strong Volume percentage is set to 150% and weak to 50%, change it as desired.

Setting Up and Reading Alerts - Adding Alerts in TradngView:

-Add indicator to chart and make sure the correct strategy is configured (check Backtesting results)

-Right-click anywhere on the TradingView chart

-Click on Add alert

-Condition: Select this indicator by it’s name

-Immediately below, change it to ") function calls only", as other wise there will be 2 alerts for every alert!

-Expiration: Open-ended (that may require higher tier TradingView account, otherwise the alert will need to be occasionally re-triggered)

-Alert name: Anything

-Hit “Create”

-Note: If ANY Settings within the indicator will be changed > DELETE the current alert and create a new one per steps above, otherwise it will continue triggering alerts per old Settings!

- Reading Alerts in TradngView:

NOTE: Each label ["COIN"], ["ENTRY"], etc. is customizable, the text can be changed of it within indicator Input settings.

Here are 2 examples of a 1)LONG OPEN alert and a )LONG SL > IMMEDIATE SHORT OPEN alert:

1)

2)

The labels are pretty much self-explanatory, but just in case:

NOTE: take-profit and stop-loss levels are considered reached only when candle bar closes beyond the level (therefore take-profit/stop-loss actual prices will be slightly different than initially shown)! Here are 2 examples with 1)TP and 2)SL crossed/touched vs actually reached/taken:

1)

2)

- COIN: Instrument which will be traded

- TIMEFRAME: Timeframe of the chart at which algorithm is working

- LONG: Direction of the trade and indication of the trade to be open

- ENTRY: Price at which the trade is open (stocks purchased)

- TP1: 1st take-profit target

- TP2: 2st take-profit target

- TP3: 3st take-profit target

- TP4: 4st take-profit target

- TP5: 5st take-profit target

- SL: stop-loss level at which trade/position will be closed at loss

- Leverage: this an informational label of leverage, does not affect the algorithm in any way

With each trade/position alert, there is all the necessary information included.

Mainly it's: Open (direction) or Close (partially/full) at alert!

Here are several alerts demonstrated:

FAQ - How fast will I be granted access to Indicator after payment?

In 24-48 hours (usually much faster)

- What if I miss a signal/alert?

There will always be another signal/alert, it is always best not to force-enter a trade, "A best trade is - no trade". However, even if a signal or alert is missed, there is always an option to create a custom alert at the entry price of the missed signal. This allows to wait for a potential opportunity. Given the typical zig-zag movement of market prices, there's a chance that the price might return to the entry point, enabling entering the trade or position. Even if the price initially moves against the trade, a trade can be entered at a more advantageous point, as long as the trade remains active. This approach capitalizes on the dynamic nature of market trends.

- Are there days when I shouldn't trade?

While our algorithms primarily rely on technical analysis and don't factor in fundamentals, it's advisable to consider avoiding trading on days when the Federal Open Market Committee (FOMC) meetings occur. Market behavior during these periods can become irrational and yield unfavorable outcomes. However, it's important to note that all our backtesting is conducted without excluding FOMC days. Therefore, even if there's a negative impact on a specific day, the overall performance should not be significantly affected over the long term.

- Can a signal or an alert be skipped due to technical issue? How reliable are our servers?

The reliability is exceptionally high. TradingView itself is a dependable platform. Our algorithm-processing servers are configured to automatically restart in case of any issues. This ensures an extremely low likelihood, around 0.1%, of missing signals or alerts. However, to be on the safe side and depending on the trading style of the channel or indicator, it's advisable to check in at the end of the day (Intraday), at least once a day (Swing) or once a week (Trend) to stay updated.

- Is slippage (commission/spread/fees) accounted for in the algorithm Backtesting?

The level of slippage depends on the specific indicator strategy configuration and the instrument being traded.

- In ourFOREXstrategies, we follow a straightforward approach. We assess our broker'sOANDA Average/Historical Spreadand then configure the TradingView indicator Properties by setting the Slippage accordingly (where 10 ticks represent a 1 PIP spread).

- In ourIndex/Stocks/Futuresstrategies, no slippage is taken into account. Our observations reveal that with the Broker we utilize, slippage impacts stock trades in both positive and negative ways. When it comes to trading options, where commissions typically hover around $0.65 per contract, this factor is relatively negligible, unless high-frequency trading with numerous daily trades (in such cases, we'll factor in the $0.65 commission for each trade, explicitly addressing it in the indicator strategy configuration information/explanation/channel).

- In the realm ofCrypto/Bitcointrading, the fee structure can differ. Certain brokers offer zero fees while factoring in spreads, while others charge fees exclusively. Based on our thorough research and observations, it's reasonably accurate to consider a 0.10% fee per order as the average. This is the fee parameter we will incorporate into our Crypto/Bitcoin strategy configurations.

With our indicator(s) purchased (as in the third section below “TradingView Trading Indicators”), slippage can be adjusted according to broker's fee structure.

|